Lisa has recently bought a fixed annuity to ensure her financial security in the years ahead. For those curious about what a fixed annuity is and why Lisa, and many others, choose it, this guide covers the basics, benefits, and important points to consider.

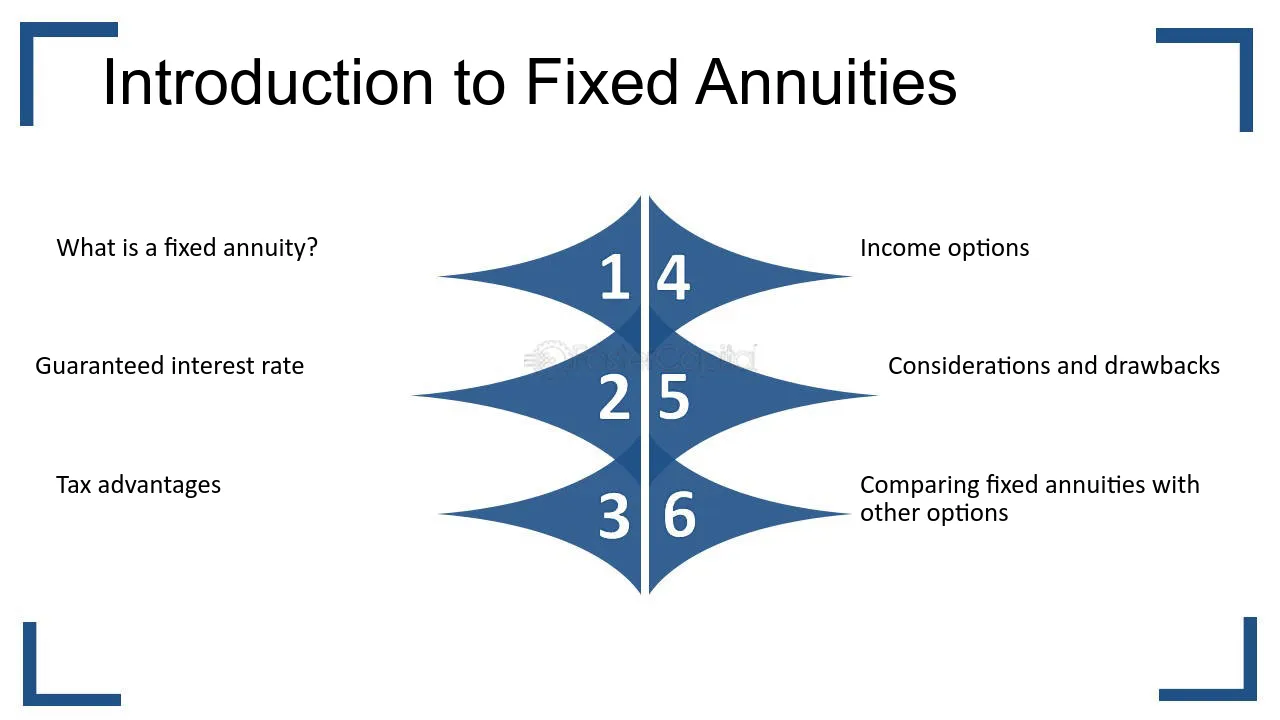

What is a Fixed Annuity?

A fixed annuity is a type of investment that guarantees a steady income over time. When someone like Lisa buys a fixed annuity, they agree to pay a sum of money to an insurance company. In return, the insurance company promises regular, stable payments over a certain period or even a lifetime. This type of investment appeals to those looking for predictable, low-risk returns.

Why Lisa Chose a Fixed Annuity

For Lisa, the decision to buy a fixed annuity came down to stability. Unlike other types of investments, fixed annuities offer a reliable income that isn’t influenced by the ups and downs of the market. Knowing that her payments are secure gives her peace of mind and helps with long-term planning.

Benefits of Fixed Annuities

Here are a few key benefits Lisa will enjoy with her fixed annuity:

- Guaranteed Income: Fixed annuities provide consistent payments, making budgeting easier.

- Tax-Deferred Growth: Earnings in a fixed annuity grow tax-deferred, meaning Lisa won’t pay taxes on the growth until she starts receiving payments.

- Safety: Since the returns aren’t tied to the stock market, Lisa’s fixed annuity offers a safer option for conservative investors.

- Flexible Payout Options: Fixed annuities offer flexibility, with payment options that can be monthly, quarterly, annually, or even as a lump sum.

Important Considerations Before Buying a Fixed Annuity

While fixed annuities are great for many, it’s essential to consider certain factors:

- Surrender Period: Most fixed annuities have a surrender period during which withdrawing funds may lead to penalties. Lisa understood this, which is why she committed to a long-term investment.

- Inflation Risks: Since fixed annuities offer fixed payments, their value may decrease over time if inflation rises.

- Fees and Charges: Fixed annuities may have additional fees. Checking these fees before buying helps to avoid surprises.

Types of Fixed Annuities

Lisa’s choice of a fixed annuity was one of several types:

- Immediate Fixed Annuity: This provides immediate payments after an initial deposit.

- Deferred Fixed Annuity: Payments start after a set period, which is ideal for those planning for retirement.

Is a Fixed Annuity Right for You?

A fixed annuity can be an excellent choice for anyone who values security and stable income. Like Lisa, if you want guaranteed returns and tax-deferred growth, a fixed annuity might be a good fit. However, assessing your financial goals and needs is key before making a decision.

I’m the kind of person to demonstrate appreciation for quality article writing when it’s deserved. You actually need to understand what a fantastic writer you’re.

I realize just how much work you should have done in order to get that much info as a whole such as this. I’m in complete agreement with you and I also really like your presentation.

I needed to look at this exceptional article again to make sure I grasped your points. I agree with many of them and also intend to return for much more.

I got into this informative article which surprises me personally as this isn’t among my personal passions. You did such a high quality work involving presenting your facts that I could not avoid reading.

Enthusiasm is actually what is absent in much of the online material I read nowadays. Your current post has got the optimum combination of compiling interest as well as nicely written material and i’m satisfied.

It is a primary instance of ideal article writing. I actually feel you’ve made logical points and also formatted that in a neat and clear technique. Thanks.

I am going through a hard time fathoming just how much research you had to accomplish for this specific data, but I like it and I accept. You tend to make a lot of sense.

When I started looking over this I truly thought I’d get lost, however you really understand how you can clarify things in your writing. Thank you so much for being so distinctive as well as discussing this specific info.